Defying Gravity

Written by Stephen Schwartz (2003)

Defying Gravity

Movie sequels often carry lofty expectations based on the success of the original. Fans are enthusiastic to find out how the story continues, who the next villain may be, or what unusual predicament the heroine will face. The sequel can allow the characters’ storylines to more fully develop or take a different turn, pulling the audience further into the developing franchise. The audience may see more of the same from original to the sequel, with the same characters telling a now-familiar story. If it worked once, why won’t it work again? These can become extraordinarily successful franchises, delivering what audiences want with few surprises. They can also turn off audiences looking for something fresh and captivating. Sequels are a challenge with some bombing, out and others sustaining the franchise for years to come.

This November brought Wicked: Part Two to a fan base with high expectations. While more of a continuation than a sequel, the movie seeks to build on the tremendous success Wicked: Part One delivered in November 2024. The story unfolds with twists and turns for the lead characters, leading up to the final scenes that complete the well-known story. Early reviews have been mixed, with some fans wanting more of the same while others looked for something to bring new life to the familiar characters.

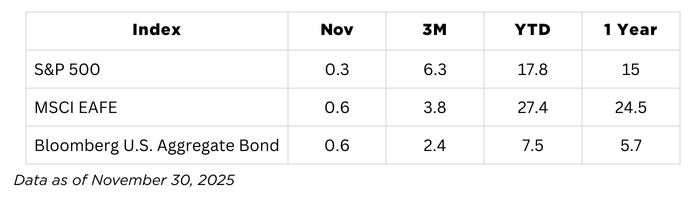

For fans of U.S. investment markets, November 2025 may appear to be a sequel to November 2024. In that month, investors responded to the presidential election and anticipated changes in policies, balancing both positive and negative economic data points, all while looking at strong YTD stock market returns driven by a small group of stocks. This November, investors dealt with a closed and then reopened US government, limited economic data that delivered mixed indicators, and a healthy market driven by a small group of stocks. The month did bring a few plot twists, including shifting expectations of additional Fed rate cuts and growing questions about the durability of the AI theme that has carried markets to record highs again and again. Investors watched market leader Nvidia fall 13%, while Alphabet (Google) rose 14% for the month and 50% for the trailing three months. Additionally, value outperformed growth, small caps modestly outperformed large, and bonds beat stocks. In this sequel, the overlooked characters had a moment to outshine the bigger stars and add some depth to what has been a relatively narrow storyline for the last couple of years.

For most of 2025, investors have been forced to address questions about the strength and durability of the fundamental drivers of market performance. There have been twists and turns as the year has played out, from sharp declines late in Q1 to the Liberation Day – inspired rally in Q2, and the long wait for the Fed to act in Q3. Investors will debate whether November 2025 was a key moment in the story’s arc or a head-fake before the final climactic scene plays out in 2025.

U.S. equity markets will have to rally hard in December to deliver the same blockbuster results of 2024 and beat non-U.S. equity markets as they hold onto their early lead. Perhaps this lays the groundwork for another sequel in 2026?

Here are observations on what occurred across the investment markets in November:

Broad Market Performance1

Domestic Equity2

-

U.S. equity markets slowed their ascent during the month due to shifts in sentiment and expectations, with mixed results across different segments, sectors, and stocks.

-

Value outperformed growth across market caps and the equal-weighted S&P 500 beat the cap-weighted S&P for the month.

International and Global Equities3

-

Non-U.S. developed market stocks outpaced U.S. equities, helped by select European markets but hurt by a negative return in Japan.

-

Emerging market stocks fell almost -2.5%, pushed lower by growth sectors and China, which declined for the second consecutive month.

Fixed Income Markets4

-

U.S. bond market returns were solidly positive in November, adding to the year’s strong returns. Interest rates were range-bound for most of the month, ending modestly lower.

Specialty Markets5

-

REITs bounced back, outperforming stocks and bonds. Commodities were mixed with oil down modestly and natural gas jumping up more than 10%. Gold and copper prices rose, finishing the month with positive momentum.

Sectors6

-

Healthcare was the best performing sector, up 9% for the month, followed by Communication Services which was lifted by Alphabet’s big rally. IT and Consumer Discretionary were the laggards for the month, down -4% and -2% respectively.

As this sequel nears its end, audiences remain uncertain of the outcome. Will equity markets continue to “try to defy gravity,” or will questions grow louder about the sustainability of the AI themes and the potential disappointment of unmet expectations? 2025 could end as a cliffhanger, bringing investors back for another round in 2026. If you have questions or want to discuss the current state of the investment markets and their impact on your plan or portfolio, please do not hesitate to reach out to your advisor.

1-6 All data referenced in the table and comments supplied by Morningstar as of 11-30-2025

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from HUB International or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision, and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professionals, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for informational purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

HUB Retirement and Private Wealth employees are affiliated with and offer Securities and Advisory services through various Broker Dealers and Registered Investment Advisers, some of whom may or may not be affiliated with HUB International. HUB International owns the following Registered Investment Advisers: HUB Investment Partners; HUB Investment Advisors; GRP Financial; RPA Financial; and Taylor Advisors. Additional information for each individual HUB International Registered Investment Advisor may be found in the respective Form ADV available on the SEC’s IAPD website at adviserinfo.sec.gov. Insurance services are offered through HUB International.

![[Video] Q4 2025 Economic and Market Commentary](https://www.hubrpw.com/wp-content/uploads/2026/01/Screenshot-2026-01-26-at-5.37.55 PM.png)