“Oh my mama told me there’ll be days like this…”

– Days Like This by Van Morrison (1995)

There is an old saying, “in like a lion, out like a lamb.” It is usually associated with the variability of spring time weather but in the case of April’s investment markets, it may take on a new meaning. April started like a lion, full of energy and roar, with huge swings to the negative and positive in response to the initial tariff plans and subsequent revisions.

Following the tariff pause inspired rally, markets settled into a more stable pattern as investors had time to assess what the tariffs, if they are actually put in place, will mean for different industries and companies. Investors also focused on how the Fed may react if expectations of a tariff induced economic slowdown become reality.

After two years of low market volatility and generally favorable market performance that may have lulled investors into a complacent mood, 2025 so far has been anything but more of the same. The transition to a new administration and their new trade and fiscal spending policies caused investment markets to become even more reactionary, moving on every piece of news whether true or later retracted or restated. “Experienced” (read older) investors will say that markets have always overreacted in the short-term but eventually find their balance.

What is different is now the magnitude and frequency of reactions are so much more elevated. Observing how quickly both equity and bond markets moved up or down intraday in April, you can hear the old-timers reminding all investors “there’ll be days like this” but it is important is to stay focused on the longer-term when company and economic fundamentals matter more than the latest tweet.

Deep into the song, the Irish bard Van Morrison sings “when all the parts of the puzzle start to look like they fit, then I must remember there’ll be days like this.” Right now, it may seem like investors are missing a few pieces of the puzzle and are on pause until they can find them and see what picture is revealed when the puzzle comes together. Until then, it is important to stay focused on the longer-term investment plan and goals that should guide investment decision making and know “there’ll be days like this.”

Here are observations on what occurred across the public markets during April:

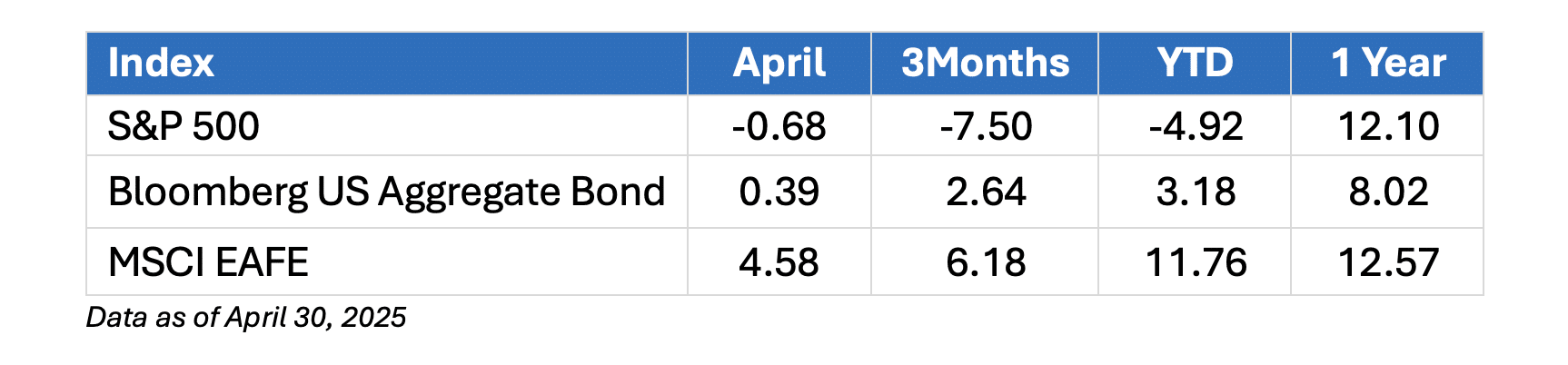

Broad Market Performance1

Domestic Equity2

- US stocks reacted quickly and sharply to a series of trade and economic news announcements during April, ending the month down modestly.

- Large and midcap growth indices managed to generate positive monthly returns while other market segments were down as value stocks fell back from their lead position after the first quarter.

International and Global Equities3

- Non-US markets continued to rally and outperform the US during the month. Many European markets benefitted from expectations for increased fiscal spending as a direct response to US policy shifts.

- After a strong Q1, Chinese stocks fell 4% as tariff talk escalated. Other emerging markets performed well on improved outlooks for growth across countries

Fixed Income Markets4

- Bonds provided positive returns during April as investors looked to de-risk, causing US short-term interest rates to fall slightly. The yield curve steepened as longer-term rates rose despite the increased volatility and uncertainty.

Specialty Markets5

- Commodities were mixed with Gold reaching new highs and oil and natural gas prices dropping more than 12% during April. REITs were down in tandem with value stocks.

Sectors6

- The big decline in oil and gas prices crushed the Energy sector (-13%). The remaining sectors posted mixed results as investors evaluated the impacts of tariffs on different segments of the economy.

If you have questions or want to discuss how this evolving landscape may impact your plan or portfolio, please do not hesitate to reach out to your advisor—we are here to help.

1-6 All data supplied by Morningstar.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from HUB International or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professionals, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

HUB Retirement and Private Wealth employees are Registered Representatives of and offer Securities and Advisory services through various Broker Dealers and Registered Investment Advisers, which may or may not be affiliated with HUB International. Insurance services are offered through HUB International, an affiliate.

![[Video] Q4 2025 Economic and Market Commentary](https://www.hubrpw.com/wp-content/uploads/2026/01/Screenshot-2026-01-26-at-5.37.55 PM.png)